Employer Tax Rates 2025. Hence, an individual will need to analyse between the old. Which financial year do you want to calculate taxes for?

The esic has fixed the contribution rate of the employees at 0.75% of their wages and the employer’s contribution. Income from 3 lakh and 6 lakh will be taxed at 5%, 6 lakh to 9 lakh will be taxed at 10%, 9 lakh to 12 lakh will be taxed at 15%,12 lakh to 15 lakh will.

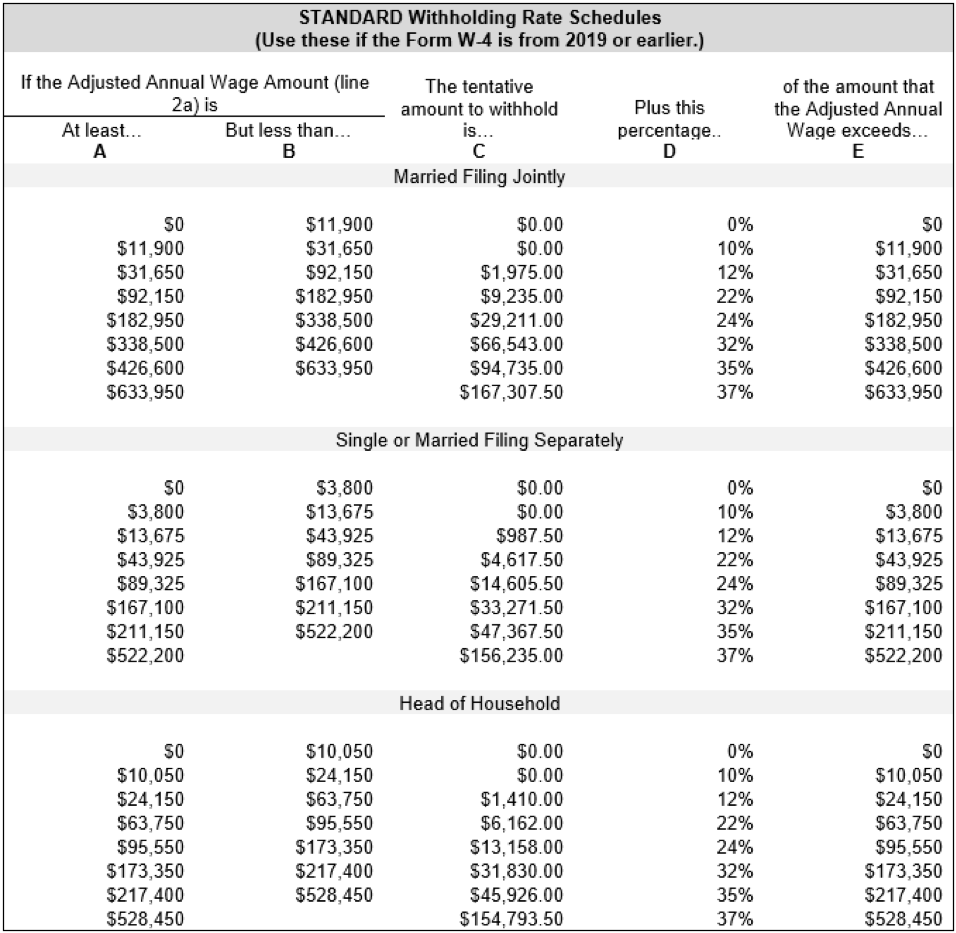

Tax rates for the 2025 year of assessment Just One Lap, Criminal charges to the employer. The federal income tax has seven tax rates in 2025:

Calculation of Federal Employment Taxes Payroll Services The, 1.45% for the employee plus 1.45%. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ).

Contribution Rates, The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. Rates and thresholds for employers 2025 to 2025.

20242024 Tax Calculator Teena Genvieve, National minimum wage change from 1st april 2025. For instance, if your monthly basic salary is rs 1,00,000.

Tax Withholding Tables For Employers Elcho Table, The new tax regime, which has low tax rates but fewer exemptions and deductions, will be the default tax regime. Income from 3 lakh and 6 lakh will be taxed at 5%, 6 lakh to 9 lakh will be taxed at 10%, 9 lakh to 12 lakh will be taxed at 15%,12 lakh to 15 lakh will.

50 Shocking Facts Unveiling Federal Tax Rates in 2025, For instance, if your monthly basic salary is rs 1,00,000. Federal payroll tax rates for 2025 are:

What Are The Different Tax Brackets 2025 Eddi Nellie, Single taxpayers 2025 official tax brackets. Some sections apply only if gross.

Calculation of Federal Employment Taxes Payroll Services The, Regular payday on friday 5 april 2025 (tax year 2025 to 2025) but paid on monday 8 april 2025 (tax year 2025 to 2025) may be treated for paye and national insurance. 6.2% for the employee plus 6.2% for the employer medicare tax rate:

Listed here are the federal tax brackets for 2025 vs. 2025 FinaPress, The irs has released the 2025 tax brackets, along with updated income tax withholding tables for employers. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ).

Autumn Statement 2025 HMRC tax rates and allowances for 2025/24, Hence, an individual will need to analyse between the old. National minimum wage change from 1st april 2025.

Information on employees’ allowances for the 2025 year of assessment the minister of finance has approved the new table of rates per kilometre for motor vehicles for.

Travel Hiking WordPress Theme By WP Elemento